The Consulting Report is pleased to announce The Top 25 M&A Consultants and Leaders of 2023. M&A occurs across all industries, often bringing companies from different sectors together. Such deals take a village to succeed, which includes investment bankers, company executives, M&A consultants, lawyers, auditors, and others in order to get a deal across the finish line.

Despite continued uncertainty about the future of the global economy, historically M&A hasn’t paused during tough times. While volatility may give executives of both targets and acquirers pause, there are those who swoop in to take opportunities while others hesitate. Of course, these companies will look for the best consultants to help navigate the best deals. These consultants are those with extensive experience in various facets of the M&A process.

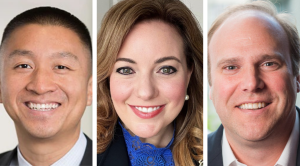

This year’s awardees represent the best in M&A consulting. Consulting leaders like Iain Macmillan, Global Leader of M&A Services at Deloitte, as well as Phillip Isom, Global Head of KPMG’s M&A division, and Christine Cheung, a Principal Consultant in Slalom’s Global M&A unit, are just a few of the accomplished specialized leaders who have made this year’s list.

Awardees were selected based on nominations and a thorough review of each candidate’s career track record up to and including their current position. Please join us in recognizing and celebrating the achievements of The Top 25 M&A Consultants and Leaders of 2023.

1. Iain Macmillan

1. Iain Macmillan

Company: Deloitte

Title: Partner, Global M&A, Transactions Services Leader

Iain Macmillan, a well-known and highly respected M&A executive, has specialized in due diligence services for more than 25 years. He currently serves as the Global Leader for all M&A Services across Deloitte and is a member of the consulting giant's extended Global Executive team. In addition, Macmillan is a partner in the U.K. firm, where he is responsible for Deloitte North South Europe’s M&A proposition. In this role, he leverages his extensive experience in complex U.K. and multinational transactions. Macmillan, who has been with Deloitte since July 2002, previously served as the firm's Global Lead Client Service Partner.

Earlier in his career, he spent 14 years at Arthur Anderson, where he also served as a partner. In addition to being a qualified accountant, Macmillan holds an MBA from Manchester Business School, and a Bachelor of Science in Economics from The University of Bristol.

2. Philip Isom

2. Philip Isom

Company: KPMG

Title: Global Head M&A

Phil Isom leads KPMG’s Global M&A practice and the U.S. Capital Advisory practice. As Global Head of M&A, Phil leads over 2,500 investment banking professionals working in over 80 countries around the world. KPMG Corporate Finance’s Global M&A platform has been ranked as the #1 middle market global advisory firm for over 20 years. KPMG Capital Advisory includes the U.S. investment bank, as well as the Infrastructure Projects Advisory, ESG, Securitization and Lender Diligence practices. Phil has over 30 years of experience in investment banking, investing, consulting and restructuring. Phil has contributed to numerous publications and has appeared on Bloomberg News and CNBC.

3. Alberto Fumo

3. Alberto Fumo

Company: Kearney

Title: Global Practice Lead, Transactions & Transformation

Alberto currently leads the Global Transactions and Transformations (T&T) practice at Kearney and has spent more than 20 years advising private equity funds and corporations across the full transaction and transformation cycle. Kearney’s T&T team specialises in helping clients assessing acquisitions and divestitures from multiple commercial, technology and operational perspectives and driving value creation for all stakeholders during the different phases of the ownership period.

4. Jeff Black

4. Jeff Black

Company: Mercer

Title: Partner

Jeff Black is a Partner with Mercer, spearheading the company’s Global Mergers & Acquisition Transaction Services business. Black brings to the table his nearly 25 years experience as a trusted advisor to leading business leaders. He specializes in assisting employers across the full spectrum of Mercer’s people-advisory capabilities. Black’s experience includes advising on the full range of M&A considerations, namely start-ups, IPOs, acquisitions, mergers, partnerships, and divestitures. In addition, he has held numerous leadership positions within Mercer’s Health business.

His previous work ventures include time as an Associate with Hewitt Associates and Towers Watson as well as time as a Benefit Analyst for W. F. Morneau & Associates. Black is currently a frequent speaker on M&A people risks, regularly partnering with Transaction Advisors and the Conference Board to offer his valued opinion. Black graduated summa cum laude with a Bachelor of Arts in English from the University of Illinois at Urbana-Champaign.

5. Rodrigo Slelatt

5. Rodrigo Slelatt

Company: McKinsey & Company

Title: Partner

Rodrigo Slelatt is one of the leading global advisers on M&A at McKinsey. As a global operating leader, he is the Global Co-Lead of M&A for all Industry Domains and the Global Co-Lead of M&A for Consumer sectors. Rodrigo has over 20 years of consulting experience, the last 12 dedicated to M&A. In this capacity, he advises CEOs and executives on all types of transactions, with a specialty on setting up and executing large transformational deals, and has been at the center of several market-shaping integrations and separations in the last decade. Rodrigo has authored several publications on M&A and frequently serves as faculty to executives on various M&A topics.

Prior to joining McKinsey, Rodrigo served as a Partner at Kearney, where he co-founded and co-led the M&A practice in the Americas. Rodrigo grew up in Argentina, lived many years in New York City, and has worked in numerous countries across the Americas and Europe. He earned a Bachelor Degree in Business Administration from Rowan University, and an MBA from the Stern School of Business at New York University.

6. Bernd Oehring (tie)

6. Bernd Oehring (tie)

Company: Oliver Wyman

Title: Partner

As a Partner with management consulting firm Oliver Wyman, Bernd Oehring serves as the Lead of Corporate M&A and Carve-outs in Industrials, Services, and Consumer while also maintaining co-coverage of the firm’s multiple financial sponsors and heading up its restructuring efforts in Germany, Austria, and Switzerland. He advises said clients on M&A and carve-out preparation and execution, including due diligence and post-merger integration (PMI) as well as strategy and business case development and overall value creation.

Before rising to his current role, Oehring spent six years as the Chief of Staff and Chief Operating Officer of Corporate Finance & Advisory (CFA) for the practice globally. Preceding his time with Oliver Wyman, he was a Senior Associate with J.P. Morgan handling investment banking and M&A. His earlier career was peppered with internships at various leading financial investment institutions such as Morgan Stanley and IVC.

Oehring earned degrees and certificates from a variety of schools, including Otto-Friedrich-Universität Bamberg, Universidad de Alcalá, HHL Leipzig Graduate School of Management, and WHU – Otto Beisheim School of Management.

6. Dhruv Sarda (tie)

6. Dhruv Sarda (tie)

Company: Alvarez & Marsal

Title: Managing Director, EMEA M&A Transformation Practice Leader

Dhruv Sarda is a Managing Director at Alvarez & Marsal (A&M) in London. At A&M, Dhruv works with corporate boards and management teams on M&A and transformation topics. Through his 23+ years of experience, he has worked on over 100 M&A transactions across the deal lifecycle (M&A strategy, diligence, post-merger integration and carve-out) and also assumed interim management roles such as Chief Integration or Transformation Officer on large-scale, full potential value capture programs. His experience covers a broad spectrum of corporate and private equity situations. Dhruv has contributed to various publications and is a sought-after speaker at M&A Forums and Business Schools. He earned an MBA from Cambridge University and a Bachelors degree from King’s College London. His charitable endeavours include supporting the work of The British Asian Trust and Our Moon Foundation.

7. Vikas Sekhri

7. Vikas Sekhri

Company: RSM US LLP

Title: Partner and National Leader, M&A Tax Services

Vikas Sekhri is partner and national leader of mergers and acquisitions tax practice at RSM US LLP. He has more than 23 years of professional services experience, including over 16 years of experience advising private equity, corporate and family office investors with respect to the tax implications of mergers, acquisitions and restructuring transactions.

As a member of RSM’s global tax services, Vikas leads the largest team of M&A tax professionals focused on middle market. Vikas assumed the national M&A tax leader role in 2020. Under Vikas’ leadership the M&A tax practice has added significant talent and has more than doubled in size since 2020.

Prior to his current role, Vikas led the northeast region M&A tax practice and served as the operations and strategy leader for the national M&A tax practice. He is past chair of the Mergers and Acquisitions committee New York State Society of Certified Public Accountants.

8. Steven Berger

8. Steven Berger

Company: Kearney

Title: Partner, HR, Leadership & Change, Transactions & Transformation Practices

Steve Berger is known for successfully using mergers and acquisitions as the catalyst for driving transformation across his client’s business and is an expert in helping organizations with their most challenging growth and performance issues. Over the course of his 30+ year career, Berger has successfully led both complex transformative as well as tuck-in integration and divesture efforts across a wide range of industries including tech, manufacturing, ag, mining and A&D on a global scale.

Berger’s approach to M&A puts people and change at the center, leveraging his experience as a former Chief HR Officer and Chief Administrative Officer for 2 publicly traded companies. Berger also focuses on HR strategy and HR transformation, where he led the transformation of his company’s culture from reactive & passive to forward-thinking & high-performing – creating a mindset of operating with excellence along the way.

Berger is also proud to serve on the board of directors of Children International, which fights to end poverty by working with children and youth to build the healthy environments that they need to thrive, empowering them to create lasting change in their own lives and communities.

9. Alex Liu

9. Alex Liu

Company: McKinsey & Company

Title: Partner, McKinsey M&A, Global Co-Leader Integration Service Line

Alex Liu is a Global Co-Leader and a Partner at McKinsey & Company. At McKinsey, Liu works closely with executive leadership teams and has an in-depth track record of delivering the full potential from M&A focused on Healthcare and Advanced Industries across all deal types. Through his 18+ years of experience across all aspects of transactions including M&A Strategy, Due Diligence / Deal Structuring, Integration and Transformation, he has helped CEOs exceed their ambitions creating exceptional value for customers, employees, and investors alike and been at the center of several transformational transactions. Alex has an in-depth passion for growth-based M&A and is a notable speaker and publisher on the topic; key publications include: “Post-close excellence in large-deal M&A”, “7 Rules to Crack the Code on Revenue Synergies”, “Integrating Marketing and Brand in M&A”, and “The 6 C’s of Cross-Sell”.

Prior to joining McKinsey, Alex served as a Brand Manager for General Mills where his passion for growth began. Alex holds two degrees from Northwestern University, a bachelor’s degree in Learning and Organizational Change and an MBA in Finance and Strategy & Management from the Kellogg School of Management.

10. Klaus Muller

10. Klaus Muller

Company: Implement Consulting Group

Title: Senior Partner, Strategy & Transformation

Klaus Peter Müller is a Partner with Implement Consulting Group (ICG), an international consulting company with 1200+ consultants across Europe and, since 2022, the US (Raleigh). ICG helps private- and public-sector companies implement strategic change with impact. ICG is consistently recognized as one of best consulting companies in EMEA for Firm Culture.

Building on his more than 25 years of experience, Klaus is working on accelerating the development of ICG in a key geographical market Germany. Klaus is a recognized expert in a variety of fields and publishes regularly on the global economic outlook. Further, he helps clients in pursuing M&A deals and realizing their full potential via innovative accelerated value creation projects.

Before joining ICG, Klaus worked for more than 20 years with another major European management consultancy, where he became partner in 2008. Klaus earned an MBA from IESE Business School in Barcelona and a Master’s in Electrical Engineering from the Technical University of Braunschweig.

11. Tim Crowhurst

11. Tim Crowhurst

Company: Cognizant

Title: Senior Vice President & Head of Corporate Development

Tim Crowhurst is a Senior Vice President and the Head of Corporate Development for Cognizant, a Fortune 200 leader in technology services. In this capacity, Crowhurst leads Cognizant’s M&A unit, helping the company to stay ahead of its rivals by making smart acquisitions. This includes expanding its operations in growth verticals, lines of service, and geographies.

He joined Cognizant in 2017, having previously spent 13 years at Goldman Sachs. During this time, he served as a managing director in the Technology, Media, and Telecom (TMT) Group, where he advised on such notable transactions as the $14 billion merger of NBC and Universal, among over a dozen other significant TMT M&A transactions. At Goldman, Crowhurst additionally covered the Advertising and Marketing Services sector; and held various staff responsibilities in the M&A Group relating to strategy and business practices. In addition, Crowhurst previously founded White Oak, an independent merchant banking and advisory practice. In 1999 he received a Bachelor's in Economics from The University of Chicago.

12. Christine Cheung

12. Christine Cheung

Company: Slalom

Title: Principal Consultant, Global M&A

Christine Cheung is a Principal for Slalom’s Global Mergers & Acquisition practice. She has a track record of leading award winning and high-performing local and international teams, being recognized with excellence in leadership, client delivery and management ability.

She holds deep expertise in driving growth strategies for global businesses and has extensive experience in due diligence, deal synergy acceleration, go-to-market strategy, post-merger integration, and global expansion. She drives bold ideas and pragmatic solutions to resolve complex and challenging topics by drawing on expertise in operating model and organizational design.

Christine advises clients across a wide range of industries including technology, retail, financial services, and life sciences, delivering successful companywide programs for multi-billion dollar global initiatives.

Outside of the Global M&A practice she is passionate about helping and building communities. She founded a pro bono program at Slalom which has supported the visions of nonprofits across Northern California.

13. Kevin Lane

13. Kevin Lane

Company: Crowe

Title: Partner, Head, Outsourced Corporate Development Practice

With over two decades of experience in private equity and consulting leadership positions, Kevin Lane currently leads Crowe’s Outsourced Corporate Development Solutions practice, where he provides M&A advisory solutions to both public and private companies. Since September 2022, Lane has also served as a Partner in the advisory services group at Crowe.

Over his career, Lane has provided expert accounting and valuation testimony in venues such as the Federal District Court, American Arbitration Association, and formal mediation. Lane, who is both a CPA and CGMA (Chartered Global Management Accountant), previously served as VP of Akoya Capital. Prior to that, he held leadership positions at Navigant and Charles River Associates. He graduated cum laude from The University of Notre Dame with a bachelor's in business administration. He also holds an MBA from The University of Chicago.

14. Nicholai Tandrup

14. Nicholai Tandrup

Company: Implement Consulting Group

Title: Senior Partner

Nicholai Tandrup is based in Munich where he serves as the Managing partner for Implement Consulting Group in Germany. He also co-leads the Global Strategy and M&A Practice. Implement Consulting Group is one of the fastest growing consultancies in Europe, founded in Copenhagen, now with more than 1,200 consultants in 6 countries.

Through more than 20 years Tandrup has supported both industrial and private equity clients through all parts of the M&A deal cycle – from M&A strategy, through due diligence, post-merger integration, to exit preparation and divestiture. He has supported numerous transactions – majority in Scandinavia, but also in other parts of Europe as well as the US and China. Most of Nicholai’s work has been focused on Industrial B2B, Building Materials, and Transport & Logistics sectors.

Prior to joining Implement Consulting Group Tandrup was a Partner with Kearney where he led the Copenhagen office. He also spent 8 years in industry, among others as Head of Strategy and M&A with Danfoss, a Global leader in energy & climate solutions and Denmark’s largest industrial manufacturing company.

15. Joseph Ring

15. Joseph Ring

Company: RSM US LLP

Title: Principal, National M&A Practice Lead

Joseph Ring joined the RSM Management Consulting group in 2018 with 25 years of experience in industry and client advisory to assemble the Management Consulting Merger and Acquisitions practice. Building on a foundation of adjacent advisory services in place at RSM, Mr. Ring has connected the broad capabilities of RSM to provide a full set of solutions to M&A clients in Private Equity and the Public Markets. He has served multinational clients across Healthcare, Life Sciences, Industrial Products, and ENRC as they transform their businesses through mergers, acquisitions, divestitures, joint ventures.

Mr. Ring’s focus on client value delivery and value creation across the deal life cycle has been the cornerstone of his advisory career. The focus on value is core to the every aspect of the practice and the approach to realizing the highest return on client investment. Speed to value, reducing the impact of change, and the fundamentals of deal financial management are the critical few and foundation of the practice philosophy.

16. Trevor Saliba

16. Trevor Saliba

Company: NMS Consulting

Title: Managing Partner, Global Head of Private Equity, M&A and Strategy

Trevor Saliba is the Founder and Chairman of NMS Consulting, a global management consulting and strategic advisory firm. Up until 2022, he served as Managing Partner, CEO and the Global Head of the Private Equity, M&A and Strategy Practice Groups. In addition to his current duties, Saliba is the acting Chairman & CEO of NMS Capital Group, a family office-backed, global-focused venture capital and private equity investment firm with investments across multiple asset classes including real estate, financial and business services, infrastructure and energy, consumer products, technology, and media.

Prior to founding NMS Capital Group, Saliba was Managing Director-Asia Pacific (Hong Kong, India, Singapore) for Platinum Capital, Ltd., a London-based hedge fund manager. Preceding that, he served as a principal advisor to a family office advising on both public and private investments, private equity, real estate, and venture capital. In his principal advisor role, Saliba assumed C-suite roles of investment or portfolio companies of the family office engaged in the construction and engineering, media, technology, manufacturing, financial services, and consumer products sector. Saliba began his financial services industry career with Morgan Stanley in 1995, prior to that working as a staff accountant/cost engineer for Tutor-Saliba Corp.

17. Ramendra Rout

17. Ramendra Rout

Company: Wipro

Title: Director of M&A

As a senior leader in Wipro's M&A function, Ramendra has helped Wipro establish best-in-class capabilities around its acquisitions' commercial and operational success. Wipro, a global digital, engineering, technology services, and consulting organization with annual revenues of $ 11 Billion+, has been a programmatic acquirer and added several capability and scale-centric assets. Its recent $ 1.5 Billion acquisition of Capco is amongst the largest ever by an Indian technology player. Rout has been fortunate to have the opportunity to lead the merger integration of Capco with Wipro.

Rout is a seasoned executive known for bringing deep acquisition expertise around M&A strategy & operations, helping drive synergies, enabling organization collaboration to differentiate positioning, and generating long-term value creation by establishing a robust target operating model. Over the years, he has been fortunate to be involved in some of the iconic transactions done by Wipro.

In his previous role at Wipro, he was pivotal in steering Wipro's growth around comprehensive technology transformation for clients in Manufacturing & Hi-Tech sectors. He is known for his proficiency in structuring innovative service models to bring Wipro's unparalleled technology offerings to clients.

18. Laura Miles

18. Laura Miles

Company: Bain & Company

Title: Senior Partner

Laura Miles is Managing Partner and Senior Partner of Bain & Company's Atlanta office. An expert in the company's Consumer Products business, she leads Bain's Global Mergers & Acquisitions and Corporate Finance practices, which include corporate diligence and merger integration. Miles has been with the company for more than 25 years. During her long tenure, she's been in charge of merger integrations across a variety of industries, including airlines, healthcare, consumer products, and telecom. A highly accomplished executive, she also serves as a member of Bain's Board of Directors.

On top of her leadership roles at Bain, Miles has leveraged her expertise in the industry to publish multiple works on the topics of M&A, consumer products, and hospitality. In 1994, she graduated summa cum laude from Duke University, where she received a Bachelor of Arts in economics. At Duke she was also a member of Phi Beta Kappa. Miles then earned an MBA from The University of Virginia, where she received the William Michael Shermet Award for Academic Excellence and the Faculty Award for Academic Excellence.

19. James Neely

19. James Neely

Company: Accenture

Title: Senior Managing Director, Strategy, M&A Global Lead

As Senior Managing Director for Mergers & Acquisitions within Accenture Strategy, James Neely is responsible for the company's global M&A client service capabilities. The recipient of a doctorate from MIT, he works with clients on major M&A efforts to address the critical issues facing their businesses. Neely began his career more than 25 years ago. Since then, he's supported some of the world's largest transactions in pharmaceutical, financial services, consumer goods, healthcare, retail, and industrial sectors. In addition to consulting, he also publishes on numerous M&A topics in some of the most respected finance organs.

Notably, his work is regularly cited by the likes of The Deal, the Wall Street Journal, CNBC.com, and many others. Neely received a bachelor’s in engineering from Alfred University before moving on to MIT, where he received a master’s in materials engineering, and a doctorate in technology, management, and policy. Upon leaving MIT, he launched a contract research company and consulted at an MIT startup – before rising to partner with Booz Allen Hamilton, Booz & Company and PwC.

20. Elizabeth Kaske

20. Elizabeth Kaske

Company: EY

Title: Partner, M&A

As a Partner in charge of overall M&A, Elizabeth Kaske is resolutely focused on M&A transactions and large-scale transformations for multinational professional services leader EY. Her experience comprises M&A due diligence, integration, strategy, business process design and intellectual property management, supply chain, fraud and risk analysis, internal audit, and finance and accounting experience with Fortune 500 companies. Kaske has extensive global experience leading large and diverse international teams in more than 40 countries, maintaining expert knowledge on leading practices and trends in the technology, social media, entertainment, and telecommunications sectors.

She was previously a M&A Partner at Deloitte handling strategy and operations with particular focus on the telecom, media, and high tech industries and specialization in transformation projects and M&A. Prior to that, Kaske was a Senior Manager with Accenture, and was also part of Xbox’s Leadership Team at Microsoft.

Kaske received a bachelor’s degree in accounting from the University of Minnesota’s Carlson School of Management and went on to earn a Master of Business Administration from Northwestern University’s Kellogg School of Management.

21. Walter Vejdovsky

21. Walter Vejdovsky

Company: Capgemini

Title: Head of Group M&A

Based in Paris, France, Walter Vejdovsky is the Head of Group Mergers and Acquisitions at Capgemini, a multinational information technology (IT) services and consulting company that boasts 360,000 team members in more than 50 countries. Fueled by cutting-edge technologies in cloud, AI, data, and software, among others, Capgemini reported 2022 global revenues of more than $23 billion. Vejdovsky, who specializes in the technology, media, and telecom (TMT) sector, joined the company in 2010. Since assuming his current role as Head of Group M&A in 2014, he's overseen more than $10 billion of cumulated deals at Capgemini.

Before coming to Capgemini, Vejdovsky was a senior investment manager for HSBC France’s Principal Investment department. He started his career as a financial analyst with the BNP group in 1993. He later joined Cheuvreux and then Santander. From 2002 to 2006, he was director of investor relations at France Telecom. Vejdovsky holds an MBA from HEC Paris Business School.

22. Patrick Donoghue

22. Patrick Donoghue

Company: BDO USA, LLP

Title: Partner, Northeast M&A Transactions & Business Restructuring Advisory Leader

Patrick Donoghue has been the Corporate Finance National Practice Leader of BDO USA, LLP since November 2022 and has been with the organization for nearly nine years. Founded in 1910, BDO's global accounting network currently operates across the U.S. and in more than 160 countries around the globe. In his time with BDO, Donoghue has advised S&P 500 companies, leading financial Institutions, hedge funds, law firms, and many more. By understanding a client's investment thesis, he guides organizations through the various intricacies of investment opportunities.

With 30+ years of industry experience, Donoghue has significant expertise in high profile leveraged buyouts, mergers & acquisitions, financing transactions, and various securities offerings – including IPOs, private placements, and syndicated loan transactions. Prior to BDO, he served in top leadership positions at Marcum LLP, FTI Consulting, and Arthur Andersen, among many others. Donoghue began his career in 1981 in financial reporting at WR Grace. He holds a bachelor's in business administration from Iona University.

23. Amanda Scott

23. Amanda Scott

Company: Willis Towers Watson

Title: Managing Director, Global M&A Leader

Amanda Scott is a Managing Director and Global M&A Leader at global insurance firm Willis Towers Watson. Having earned a stellar reputation as a connector internally and externally, she is responsible for leading a global team that helps clients evaluate and address the critical people-related issues, assets, liabilities, risks and opportunities surrounding corporate transactions. As a Global Client Relationship Director, Scott is responsible for managing, growing and strengthening successful client relationships with impressive global companies.

Prior to beginning her journey with WTW, she was with Mercer for over nine years as a Principal and Client Manager, helping to manage, grow, and strengthen client relationships with several of Mercer's largest clients. She worked her way up with Mercer, starting out as an Actuarial Analyst, evaluating the assets and liabilities of large corporations and offering guidance regarding the execution of pension plans.

24. Alexander Schnieders

24. Alexander Schnieders

Company: Teneo

Title: Senior Managing Director, Co-Head, M&A

Triple threat Alexander Schnieders is the Head of FIG, Co-Head of M&A, and Senior Managing Director for consulting and advisory firm Teneo, where he is charged with sourcing and executing M&A insurance transactions and providing broad coverage for life and property/casualty insurance clients. Over the course of his more than 18 years of investment banking experience, Schnieders has managed over 50 transactions valued at over $25 billion, including M&A, IPOs, fairness opinions, and senior debt placements.

Prior to joining Teneo, he was a Managing Director in the U.S. Financial Institutions Group at Perella Weinberg Partners as well as a Managing Director in the Financial Institutions Group at Goldman Sachs & Co. and co-head of its U.S. Insurance M&A Team for over a decade. Schnieders received a bachelor’s degree in history and literature, magna cum laude, from Harvard College and a Master of Business Administration from Columbia Business School.

25. Rishi Marwaha

25. Rishi Marwaha

Company: Marsh McLennan

Title: Managing Director, Head M&A Advisory America

Rishi Marwaha is a Managing Director at GC Securities via Marsh McLennan, where is responsible for capital and M&A advisory for insurance companies in the U.S. During the course of his career, Marwaha has advised on over $20 billion of mergers and acquisitions, capital raising and strategic advisory assignments for mutual and publicly traded P&C insurers, life insurers, reinsurers, insurance service companies, and other financial institutions.

Prior to joining Guy Carpenter in 2019, Marwaha was a senior banker in the Financial Institutions Group at Credit Suisse, focusing on M&A and capital markets transactions for large cap insurance companies. Before coming to Credit Suisse, he was a member of the Financial Institutions Group at Goldman Sachs, where he rose through the ranks ahead of eventually becoming co-captain of Insurance M&A. Marwaha started his career proper at Citigroup, in the Investment Banking Division.

____________________

Copyright: The Top 25 M&A Consultants and Leaders of 2023 publication is copyrighted material, produced and published by The Consulting Report. For information pertaining to content permissions, please refer to The Consulting Report’s award usage regulations.